Napa Valley College Participates in Financial Literacy Pilot Program

Robin Darcangelo and Chris Farmer have created a partnership with the California Community College Chancellor’s Office to participate in a pilot program to bring financial literacy to Napa Valley College. NVC’s HSI grant, Caminos al Éxito, is supporting the initiative to train staff and students to support student success and retention through the delivery of useful budgeting and credit-focused financial literacy.

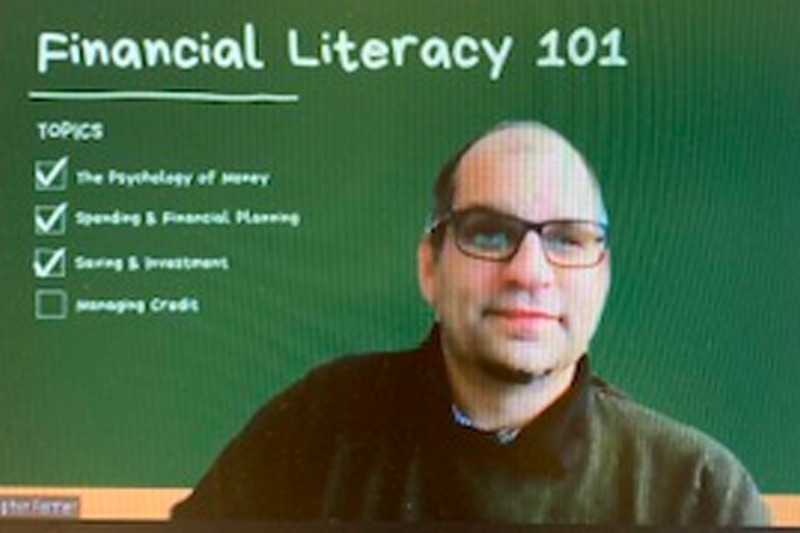

More than 50 staff and students participated in the initial five-session training, which ran February 5 through March 26 and was led by CJ Juleff, financial literacy consultant and John Pierson, Pierson and Associates, who provided an array of information and tools that will ultimately support students. Chris Farmer was instrumental in coordinating the training efforts and sharing weekly quotes to encourage staff to really think about how the information they were learning could be used to support our students.

Next steps include the development of a LibGuide in both English and Spanish (thanks to Brian Lym and Luis Cardona) that faculty and staff can use to guide financial wellness conversations in the classroom and in other student settings. Students will have access to all of the resources in the LibGuide.

An Advisory Committee will develop strategies to educate partners across campus to use the financial literacy tools and resources to support our students. NCV students will benefit from a better understanding of financial wellness, supporting their ability to complete their major and transfer to a four-year college or university.

Thank you to all of the faculty, staff and administrators who participated in the pilot program and took the time to learn, grow and better understand financial wellness. We are looking forward to more opportunities to share information that will support our students and their success.

Following is a more in-depth overview of the project with the Chancellor’s Office, including some statistics which drive home the need of this initiative.

It’s not the power of money, it’s the power of knowledge.

– Bill Daniels, founder of the Young Americans Bank

Money management is a ‘basic need’ for a community college student. Look at some of these descriptive data points which the CCCCO extracted from the Ohio State University’s Study on Collegiate Financial Wellness and the non-profit Trellis Company’s Student Financial Wellness Survey of community college students, both of which included a significant subset of data from California community colleges:

- 75% of community college students are working either full or part time

- Nearly 50% of community college students consider dropping out of school because of financial difficulties

- 70% of community college students have experienced financial difficulties while enrolled in current institution

- 45% of community college students said it would be unlikely that they could come up with $400 in cash for a financial emergency during the school year

- 74% of community college students agreed or strongly agreed that they were ‘stressed out’ about their personal finances in general

It’s clear from this data that student success…with success being measured not only by academic success but the ability to sustain enrollment over any period of time…must include the ability to effectively manage money. Survey data tells us that a majority California community college students are partially or fully self-supporting, that they consider withdrawing from school because of they are unprepared for money management challenges.

NVC, along with Cabrillo, Alan Hancock, Reedley and Riverside Colleges, is partnering with the California Community College Chancellor’s Office (CCCCO) to shine a light on this largely unaddressed student success issue head-on. The objective of this initiative is to better prepare California community colleges to more effectively listen for and constructively respond to students who are in the midst of money management challenges, and thus increasing the likelihood of continued and successful enrollment. Our concurrent goals in this effort are to create not only effective money management resources for NVC students, but to assist the CCCCO to develop effective money management resources that can be deployed by our fellow institutions throughout the California community college system. We are working directly with two CCCCO-provided consultants, CJ Juleff and John Pierson, on this initiative.

This project was launched earlier this semester. As a first step, we completed a five-part course for NVC ‘high touch’ staff, i.e., faculty and staff who interact frequently with first year/first time NVC students. This training was designed to enhance the money management knowledge and comfort of our high touch staff, preparing them to both identify NVC students who are experiencing money management challenges, and to provide useful support and guidance. As part of this first step, our ‘high touch’ faculty and staff will be invited to join together to form an advisory group which will help to set the direction of this initiative at NVC.

Similarly, this summer we will be launching training for ‘high touch’ students, i.e., student ambassadors and NVC student employees who routinely interact with their fellow students, to both ‘listen for’ and respond to students who may be experiencing money management challenges.

In addition, we are working with the CCCCO to implement and deploy other resources which NVC staff and students can use, including:

- A 15-part canvas-based course which students can use independently to learn how to more successfully address money management challenges. This canvas-based resource can also be used as individual, stand-alone topics by faculty and staff interested to integrating money management discussions into classroom and/or group settings.

- A 20-part ‘pushed’ text/email messaging package which we will use to electronically deliver brief but useful money management messages to targeted NVC students, messages focusing on the effective management of budget and credit

- A series of short recordings discussing the most important money management concepts that community college students and their families need to know in order to successfully navigate community college

- An opportunity for a small number of ‘high touch’ NVC faculty and/or staff to receive additional training to become certified financial educators, enabling NVC to build the internal capacity to develop other money management resources in the future.

In addition to the CCCCO initiative, we are also exploring how our CCCCO consultants might assist us to build money management resources into our CCCCO-driven ‘basic needs’ initiative and to develop money management resources that could be made available to UC and CSU institutions that receive significant numbers of NVC transfers.

Recent Articles

- NVC Annual Report 2023-2024

- Murals at NVC's student housing project complete

- Latinx Heritage Month 2024

- Moving day: Napa Valley College welcomes students to new on-campus housing complex

- Graduate praises college as a place of “fertile ground”

- Graduate emphasizes importance of “showing up”

- Future Winemaker Launches Career at NVC